The Best Guide To Planner

Wiki Article

Rumored Buzz on 401(k) Rollovers

Table of ContentsThe Main Principles Of Traditional The Best Strategy To Use For Life InsuranceExcitement About 401(k) Rollovers

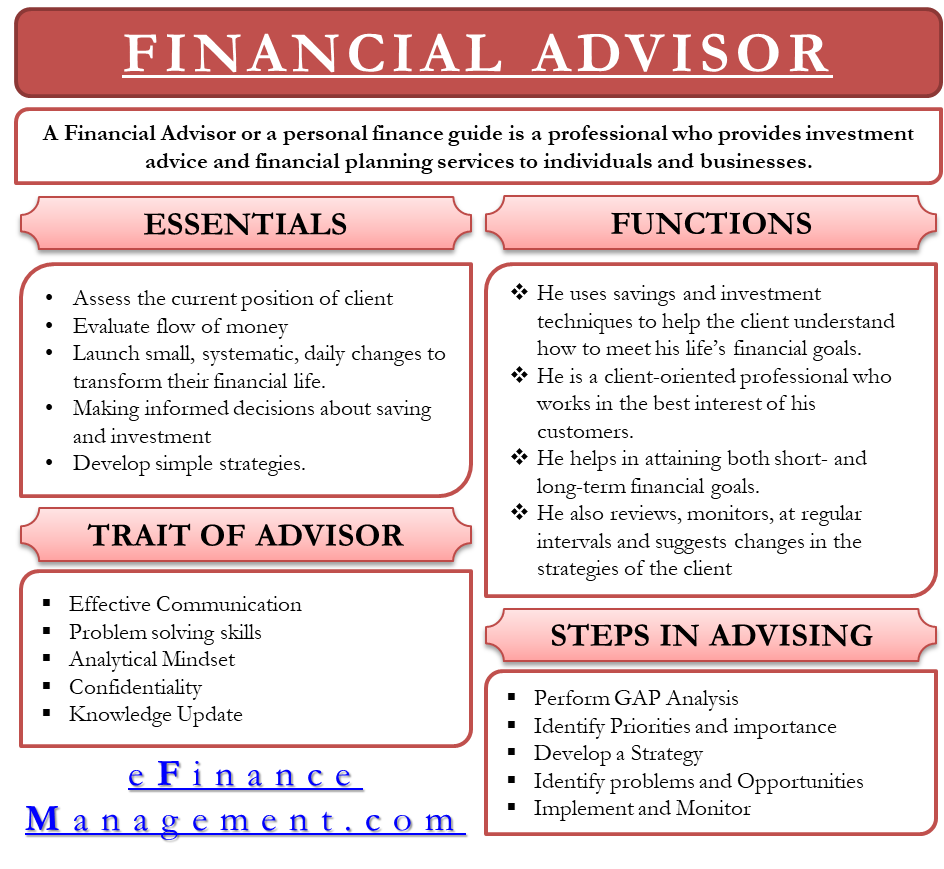

A monetary expert works as a relied on advisor and overview, using their know-how and also knowledge of monetary markets to create customized economic strategies as well as techniques that satisfy each customer's special demands and also goals. They function to help their clients attain a steady monetary future and protection as well as help them browse complex financial decisions and difficulties.

The 9-Minute Rule for Advisor

An economic advisor can assist you deal with and take care of any type of arrearages as well as establish a method to come to be debt-free. A financial consultant can aid you intend to disperse your assets after your fatality, including creating a will and establishing counts on. A financial expert can aid you recognize and handle the threats linked with your economic circumstance and also financial investments - Financial Advisor.

A monetary consultant can assist customers in making investment decisions in several methods: Financial experts will certainly work with clients to comprehend their threat tolerance and develop an individualized investment approach that lines up with their objectives as well as convenience level. Advisors normally advise a diversified profile of investments, including stocks, bonds, as well as other possessions, to assist minimize risk and take full advantage of potential returns.

Financial experts have substantial expertise and experience in the economic markets, as well as they can assist clients recognize the possible advantages and dangers connected with different financial investment options. Financial consultants will on a regular basis assess customers' portfolios as well as make suggestions for modifications to guarantee they continue to be aligned with clients' goals and also the current market problems (Advisor).

Advisor Fundamentals Explained

Yes, a monetary advisor can aid with debt management. Financial debt management is crucial to total monetary planning, as well as monetary consultants can provide guidance and support in this location. A financial expert can assist customers understand their debt scenario, examine their existing financial debts, and also produce a financial debt administration strategy. This may consist of developing techniques for repaying high-interest financial debt, consolidating financial debt, and also producing a spending plan to manage future investing.

These designations suggest that the expert has completed substantial training and also passed exams in economic planning, financial investment administration, and also various other appropriate locations. Try to find monetary advisors with numerous years experience in the financial services industry. Advisors that have remained in the area for a long period of time are most likely to have a much deeper understanding of the economic markets and investment approaches and may be better equipped to deal with complicated monetary situations.Ask the economic advisor for recommendations from present or past clients. Financial consultants commonly obtain financial planning firms near me paid in among several methods: Some financial advisors make a compensation for offering monetary products, such as mutual funds, insurance coverage items, or annuities. In these instances, the advisor gains a percentage of the product's list price. Various other financial consultants service a fee-based design, billing a cost for their guidance as well as solutions. Some monetary experts work for banks, such as banks or brokerage firm companies, and also are paid a wage. In summary, financial advisors make money on a compensation, fee-based, and income. Below are ways to locate a respectable monetary expert: Ask pals, family, or coworkers for references to monetary advisors they trust as well as have collaborated with. Once you have a listing of prospective consultants, study their histories as well as qualifications. Examine if they have any disciplinary background or issues with regulatory firms, such as the Financial Industry Regulatory Authority (FINRA) or the Stocks as well as Exchange Commission (SEC). Set up a meeting or appointment with each advisor to review your financial objectives and also to ask concerns concerning their experience, financial investment approach, and settlement design. Confirm that the economic consultant has the proper licenses and certifications, such as a Licensed Financial Coordinator(CFP)designation or a Collection 7 certificate. Select a consultant you feel comfortable with as well as depend handle your finances. It's vital to discover an expert who listens to your demands, comprehends your economic situation, and has a tested performance history of helping clients accomplish their monetary objectives. Nonetheless, dealing with a monetary expert can be highly useful for some individuals, as they can give valuable proficiency, assistance, and also assistance in managing finances as well as making financial investment decisions. Furthermore, a monetary consultant can help produce an extensive monetary plan, top financial planning companies make suggestions for financial investments and more info here also risk management, and offer recurring assistance and keeping an eye on to aid make certain customers reach their economic goals. Additionally, some individuals may prefer to do their research as well as make their very own investment decisions, and for these individuals , paying an economic consultant may not be necessary. A licensed financial investment consultant(RIA )is a professional that supplies investment suggestions as well as handles client profiles. They are signed up with the Securities as well as Exchange Commission (SEC )or a state safety and securities regulator. This can consist of budgeting, financial obligation management, insurance coverage policies, and also investment systems all to improve their clients'total wide range.

Report this wiki page